Your coverage needs are as unique as you are.

At AmFi, we believe life insurance should be tailored to each individual based

on their specific financial circumstances, responsibilities, and future plans.

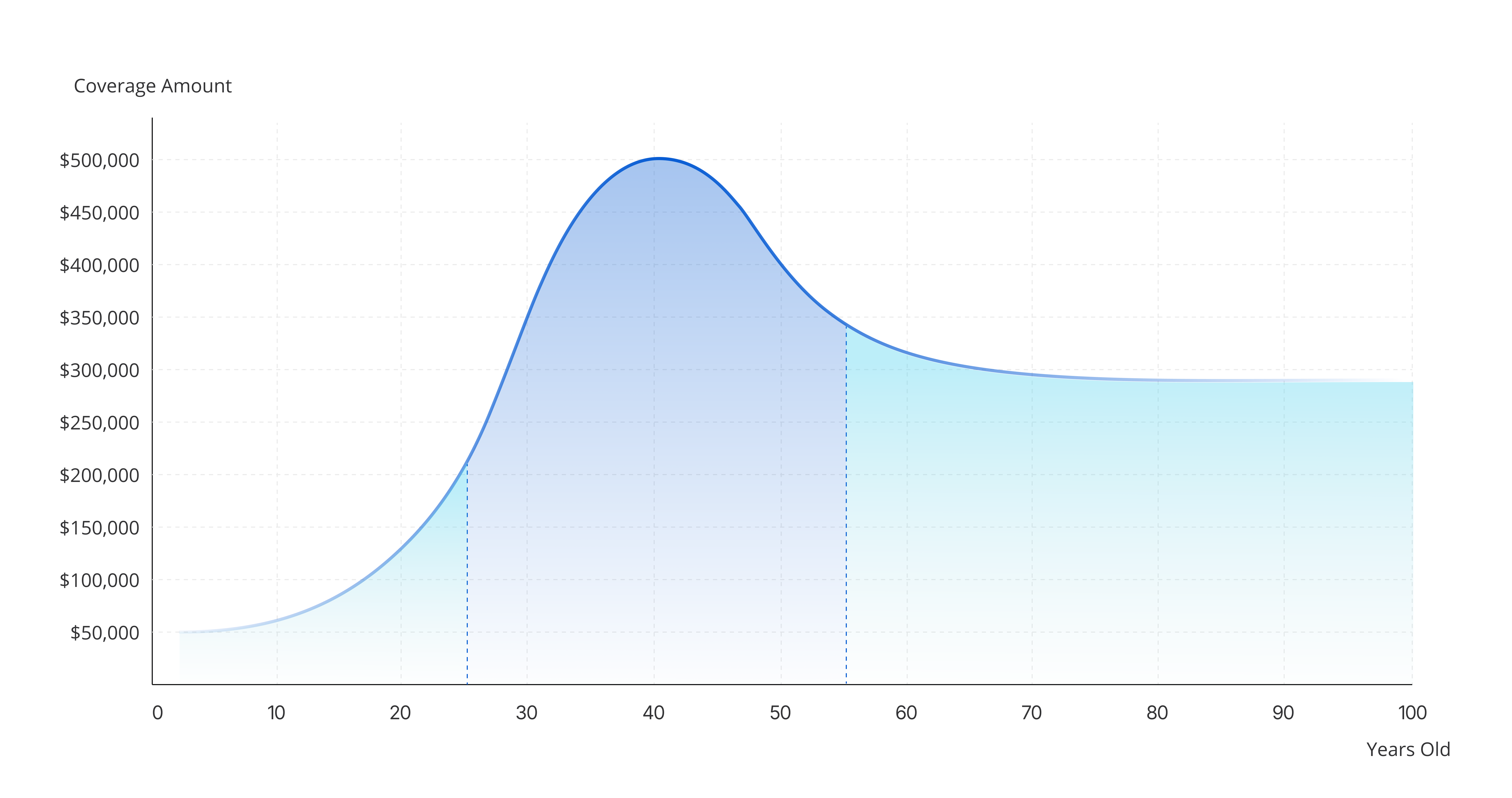

The amount of coverage you need can change over time.

As your life changes, so should your insurance; whether it’s a new addition, mortgage, or milestones, regular reassessment ensures your coverage aligns with your evolving needs.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

You’ll want to consider...

Before you start to calculate your coverage needs, there are several factors you’ll want to consider:

Household Expenses

Ensure your family can maintain their current lifestyle by securing coverage for day-to-day expenses such as housing costs, utilities, groceries, and transportation.

College Expenses

Provide adequate financial support for your dependents’ education in the event of your death.

Outstanding Debts

Protect your loved ones from financial burdens like outstanding loans or credit card debts.

Medical Expenses

Safeguard your family’s financial security by ensuring there are funds available to cover medical bills, ongoing healthcare expenses, or potential long-term care needs.

End-of-Life Expenses

Cover the costs of your funeral, burial, or cremation to give your loved ones peace of mind in a difficult time.

Mortgage

A mortgage is a substantial financial commitment, and if you were to pass away, your family might be left with the responsibility of continuing mortgage payments.

Household Expenses

Guarantee that your family can sustain their existing lifestyle, covering day-to-day expenses such as housing costs, utilities, groceries, transportation, and other routine expenditures.

College Expenses

Ensure adequate financial support for your dependents' education in the event of your death.

Any Other Debts

You’ll want to ensure that the policy's death benefit can cover outstanding financial obligations and prevent a burden on your beneficiaries.

Final Expenses

You may want to be sure that there are funds available to cover funeral and burial costs, relieving your family of the financial burden associated with end-of-life arrangements.

So, how much coverage do you really need?

While consulting with an agent is optimal for a comprehensive assessment, if you prefer a broader

perspective on life insurance, this straightforward calculation can serve as a solid starting point,

representing your “ideal coverage amount.”

Meet Adam

Adam is 40 years old, he makes $65,000 a year, has a wife and two kids ages 7 and 11.

Adam wants to cover these expenses with his policy:

$175,000

to pay off his house

$90,000

for future college tuition costs

$20,000

for his vehicles

$7,000

for funeral and burial

$5,000

for credit card bills

$297,000

IN TOTAL EXPENSES

Now Here Is The Math...

Let’s take Adam’s salary, $65,000, and multiply it by seven to get Adam’s ideal coverage needs.

How Is That Money Spent?

The $455,000 in coverage is tax free cash to be used at the discretion of Adam’s beneficiaries. However, Adam’s family would likely use it to pay off debts and provide financial cushion to supplement for the loss of Adam’s income.

Ready To Take The Next Step?

The formula, multiplying your salary by 7, provides a solid beginning, but you don’t need to navigate this process by yourself. A life insurance expert from AmFi is ready to assist you in applying for the ideal type and amount of coverage. We’ll address all your questions, and identify the right life insurance plan that aligns with your budget and goals.

Frequently Asked Questions

FAQ

Term life insurance provides coverage for a specific period and offers a death benefit if you pass away during the term. Universal life insurance, on the other hand, provides lifelong coverage and offers a death benefit alongside the potential to accumulate cash value.

Most adults who are in good health can apply for life insurance. Adults under the age of 59 are eligible for universal life insurance policies. Only individuals between the ages of 20 and 50 are eligible for term policies. You may not be eligible for life insurance if you have cancer, heart conditions, or other life-threatening medical conditions or lifestyle habits.

Absolutely! We pride ourselves on being there for you when you need us. We process claims in less than 24 hours and typically have the cash in your bank account within 3 days.

Members with SGLI coverage have two options if they want to convert their life insurance after their service ends. The first option is that they can convert their SGLI to VGLI, a renewable term insurance that has no cash value that builds over time and has premiums that can increase over time, making it a more expensive option long-term. The second option is that they can convert their SGLI to an individual commercial policy with providers like American Fidelity. American Fidelity’s coverage is meant to provide a more permanent alternative that keeps your costs low and provides full benefits, including cash accumulation.

SGLI is issued to active-duty service members, and once these service members are discharged, they have 120 days during the military separation period to transfer to either VGLI or a commercial permanent policy. Additionally, Retired Reserve soldiers are typically not eligible for SGLI and must convert to one of these options. You cannot convert SGLI to both VGLI and individual commercial life insurance at the same time. However, there is nothing preventing you from converting to one and separately obtaining the other. Converting your SGLI to a VGLI policy can be cost-effective at first, but over time, it doesn’t provide any living benefits and gets more expensive as you grow older. Our universal life insurance policy allows you to stay covered at a fixed rate and offers living benefits like cash accumulation.

To convert from SGLI to an individual permanent insurance policy with providers from participating companies like AmFi, you must also convert within 120 days of the date of separation from the military. After this period, you still have an additional year to convert, but you would have to show proof of insurance and good health to convert if it’s past the initial 120-day period.

Policies with AmFi start at $9 per month. The exact amount you pay each month (your premium) is determined by your choices in the coverage amount and length of term, as well as your age, health, and lifestyle choices.

No. With our 5, 10, and 20-year term policies you will be charged the same amount every month for the duration of your policy. When the policy expires, your rate may change based on age and insurability at that time.

We sure do. We don’t advise canceling your policy because your coverage will lapse, but if you cancel within the first 30 days, then we will issue you a full refund. If you cancel after the initial 30 days, then we’ll simply stop charging you.

In addition to life insurance coverage, this policy grows cash value that isn’t taxed right away. This cash asset is a tremendous advantage of our universal policies.

Please contact our office or one of our agents to discuss the universal life insurance policy and to see whether this is the best policy for your needs.

Just like with all our policies, the death benefit is completely tax free. The universal policies accumulate cash value that is tax-deferred. Please contact our team to learn more.

The Policy Owner must complete the appropriate form for the requested change. Forms may be downloaded and printed from the Forms Link after logging in. The Policy Owner may also contact a Service Representative at the Home Office or send us a message through our Contact Us page.

You may contact a Service Representative or register online. By registering online you will be able to view premium payments, make withdrawals and much more. Click here to register.

Upon the death of the Insured, you will contact the Home Office Claims Department to report the death. Be prepared to advise us of the insured’s name, the date and cause of death, and the name, address, and telephone number of the person who should be contacted. A Claimant’s Statement and additional information on how to file a death claim will then be sent to the named beneficiary(ies). You may click the “Claims” link at the top of this page to download the Claimant’s Form and instructions.

Please contact our office immediately to update your banking details and ensure that your valuable coverage isn’t lost.