Our Mission

American Fidelity was founded in 1956 by decorated WWII Marine, Charles Woodbury. As a combat aviator Mr. Woodbury was instilled with a sense of purpose, commitment and all the values and traditions that make our military and country the strongest in the world. His legacy and our mission today is to help improve the quality of life and security for those who serve by offering unique and stable financial products designed specifically for their retirement and insurance planning.

Our Founder’s Vision

Charles Putnam Woodbury was a man of vision. His forward-thinking and blue-collar work ethic helped him become one of Northwest Florida’s most successful businessmen. He loved his country and the military members who fought to protect it. He was also a family man and community leader who gave back generously. Few people in American history were as devoted to their country and community as Mr. Woodbury.

Originally from Kansas City, MO., Mr. Woodbury was nineteen when his father died prematurely. He was forced to leave college in Arizona and move home to care for his mother and four sisters. This was an early lesson for him in the value of life insurance.

Our History

The history of American Fidelity Life Insurance is rooted in service to our country

and our military.

-

1940

-

1941

Pearl Harbor is attacked, prompting Charles Woodbury to join the Navy as an aviation cadet.

-

1942

Mr. Woodbury served in the Marine Corps as a combat fighter pilot of the F-4U Corsair plane. He survived 7 downed planes in the Pacific Theatre and was awarded numerous medals, including the Distinguished Flying Cross, Air Medal with Gold Stars, Purple Heart, Presidential Unit Citation with Bar and the Bronze Star.

-

1946

Mr Woodbury marries Eleanor Gunn (also a Marine) and moves to Pensacola, FL. He continued to remain in the military as a reservist until he retired as a Major after twenty years of service.

-

1956

Mr. Woodbury starts American Fidelity Life Insurance to insure the highest-at-risk members of our military and their families.

-

1990

American Fidelity Life Insurance passes over $2B in life insurance in force, making it one of the leading financial institutions in America.

-

1996

With the help of her family, Marilyn Woodbury takes the helm after the tragic passing of her father, the late Mr. Woodbury, carrying on her father's selfless approach to helping our military get a little closer to realizing their dreams.

-

Present

Our Values

At AmFi, our values serve as the guiding principles that underpin our commitment to safeguarding your family’s future and ensuring financial security.

Excellent Support

We’re committed to providing each of our customers with support they can count on. You protect your family. We protect you.

Financial Stability

Unlike other insurance companies who invest in junk bonds and derivative instruments, we only invest in strong, safe assets such as high interest government notes and bonds.

Patriotism

We take great pride in serving the interests of our country by supporting the unique needs of the military and first-responder communities while backing only US-based companies.

High Standards

We uphold ourselves to the highest standards of business. We only offer products that incorporate sound planning, flexibility, tax-deferred capital/cash accumulation, and life benefits for our customers.

Integrity

Mr. Woodbury was a man of impeccable character and integrity, and these principles underpin everything that we do.

Family-Centric

We’re a family-run business and will always be committed to prioritizing the well-being and financial security of your loved ones above all else. We care for you as part of our greater family.

Our Values

At AmFi, our values serve as the guiding principles that underpin our commitment to safeguarding your family’s future and ensuring financial security.

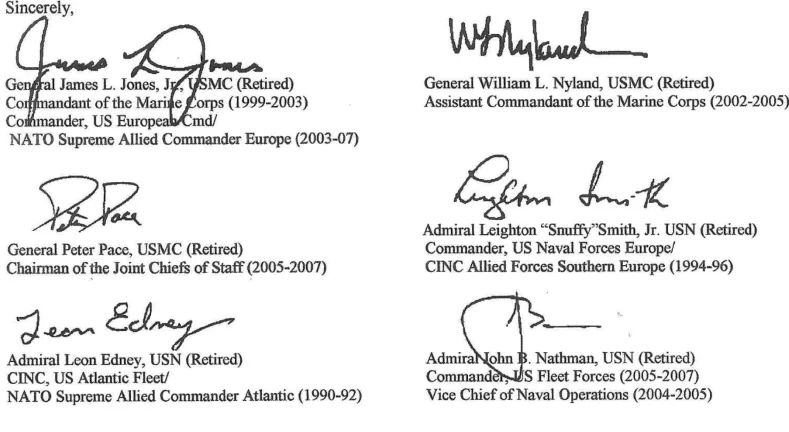

Trusted By Our Military Community

Read about how our nation’s top Generals view American Fidelity Life Insurance and the

services we provide to the military community.

Open Letter from Former Military Commanders

In support of access to responsible businesses offering reliable

financial products and opportunities

We are writing to encourage your support for our men and women in uniform by ensuring their access to legitimate, reputable financial opportunities beyond those offered by the U.S. government.

Specifically, Trans World Assurance Company and American Fidelity Life Insurance Company have a long history of serving and supporting our military. Founded more than 45 years ago by WWII veteran Charles Woodbury, these companies served as a founding underwriter of the Servicemembers Group Life Insurance, (SGLI) which continues to provide insurance to our military families today. The Woodbury family remains deeply involved in the business, dedicated to the mission of supporting our military personnel. Based on many years of experience, each of us considers Barbara Woodbury-daughter of these companies' founder-to be a true patriot. In both her personal and professional endeavors, Barbara works tirelessly in support of our troops and their families, and we hold her in the highest regard.

Sadly, we recognize that all companies and their executives do not maintain the same ethical standards that we accept as "common virtues" of those in uniform. We applaud vigilant leaders who protect our dedicated military personnel from unscrupulous sales practices, but we would ask that you not punish all companies for the actions of a few.

We are not employees or otherwise affiliated with either of these companies. Our only interest is in providing today's military members with access to credible, legitimate financial opportunities. We believe that those who defend our country deserve the opportunity to supplement their government programs with products from other providers, especially when those providers have a good track record. We encourage you to ensure they have access to the same diversity of financial opportunities enjoyed by our nation's civilian workforce. Armed with accurate information on available opportunities, we are confident that today's men and women in uniform will make educated decisions that will positively impact their future.

We specialize in serving the unique

needs of these communities

We hold deep roots with our service members and feel proud to share this open letter written and signed by top Generals and Admirals of our armed forces.

Active Duty & Veterans

AmFi is a founding underwriter of the Servicemembers’ Group Life Insurance (SGLI) and we support our active duty and veteran communities.

Federal Employees

Whether you work for a federal agency or in a commissary on base, we protect the financial future of all those who serve our country.

First Responders

First responders put their lives on the line every day in service of their communities. You protect us and our families. We protect you and yours.

National Guard

Just like you respond to the needs of our country, we support the evolving needs of your family’s financial future with world-class insurance products.

Active Duty + Veterans

By choosing AmFi, you can create that very same comfort and protection you provide, back to your cherished loved ones at home.

Federal Employees

Just as you provide security on the job, you can also protect your family’s financial security at home.

First Responders

We’re here for you, just as you’re here for us. Experience peace-of-mind while you protect your family’s financial future.

National Guard

Take care of your family’s well-being by considering the life insurance member benefits offered through your state National Guard association.

Creating Products That Honor

& Protect Your Legacy

American Fidelity is licensed in 47 states and worldwide. Our history speaks for

itself and our values continue to be our driving force.

GET APPROVED IN MINUTES

Term Life Insurance

A form of life insurance that covers the insured person for a certain period of time

Universal Life Insurance

A permanent policy pays a death benefit whether you die tomorrow or live to be 100.

Detailed Report

We compare favorably to 25 of the leading life insurance companies,

according to reputable Independent Reports.

Frequently Asked Questions

FAQ

Term insurance is a set amount of coverage for a set amount of time. Our term coverage is cost-effective and has a level premium. Once the term of your policy is up you will be required to re-apply for coverage. The coverage premium is calculated based on your current age, so don’t be surprised to see your term rates increase substantially if you choose to renew your term policy, assuming you’re still eligible for coverage. You can see if you qualify and apply for coverage online by clicking “Get a Quote”.

We believe term coverage is an inexpensive way for you to fill your insurance needs. However, the best form of life insurance coverage is permanent insurance. AmFi’s permanent policies provide lifetime level premiums regardless of age and medical changes. AmFi’s permanent policies also provide tax-deferred cash value growth. Contact our office or your local representative to learn whether permanent insurance is right for you.

While the guaranteed rate on a policy will never change, the current rate may. Interest rates, as well as the economy, have proven to fluctuate. This means your crediting interest rate will most likely change from time to time. Please contact us for the current interest rate for your policy. This does not apply to term life insurance policies.

Policies start at $9 per month. The exact amount you pay each month (your premium) is determined by your choices in the coverage amount and length of term, as well as your age, health, and lifestyle choices.

No. With our 5, 10, and 20-year term policies you will be charged the same amount every month for the duration of your policy. When the policy expires, your rate may change based on age and insurability at that time.

We sure do. We don’t advise canceling your policy because your coverage will lapse, but if you cancel within the first 30 days, then we will issue you a full refund. If you cancel after the initial 30 days, then we’ll simply stop charging you.

In addition to life insurance coverage, this policy grows cash value that isn’t taxed right away. This cash asset is a tremendous advantage of our universal policies.

Please contact our office or one of our agents to discuss the universal life insurance policy and to see whether this is the best policy for your needs.

Just like with all our policies, the death benefit is completely tax free. The universal policies accumulate cash value that is tax-deferred. Please contact our team to learn more.

The Policy Owner must complete the appropriate form for the requested change. Forms may be downloaded and printed from the Forms Link after logging in. The Policy Owner may also contact a Service Representative at the Home Office or send us a message through our Contact Us page.

You may contact a Service Representative or register online. By registering online you will be able to view premium payments, make withdrawals and much more. Click here to register.

Upon the death of the Insured, you will contact the Home Office Claims Department to report the death. Be prepared to advise us of the insured’s name, the date and cause of death, and the name, address, and telephone number of the person who should be contacted. A Claimant’s Statement and additional information on how to file a death claim will then be sent to the named beneficiary(ies). You may click the “Claims” link at the top of this page to download the Claimant’s Form and instructions.

Please contact our office immediately to update your banking details and ensure that your valuable coverage isn’t lost.

Speak With Our Team

From specific questions to general inquiries, we’re always happy to hear from you.